TABLE OF CONTENTS

Narrative

Disclosuredisclosure to

Director Compensation Tabledirector compensation table

Pursuant to our

Non-Employee Director Compensation Policy,non-employee director compensation policy, each non-employee

Directordirector will receive a cash retainer for service on the

Board of Directorsboard and for service on each committee on which the

Directordirector is a member in the following amounts:

| | | | Annual Retainerretainer

($) |

Board of Directors: | |

Non-Executive Chair | $ | 150,000 | |

All Non-Employee Directorsnon-employee directors | | | 95,000 | |

Additional retainer for Lead Directorlead director | | 30,000 | 50,000 |

Audit Committee:committee | | | |

| Chair | | | 30,000 | |

Members (other than the Chair)chair) | | | 12,500 | |

Compensation Committee:committee | | | |

| Chair | | | 25,000 | |

Members (other than the Chair)chair) | | | 10,000 | |

Nominating and Corporate Governance Committee:corporate governance committee | | | |

| Chair | | | 18,000 | |

Members (other than the Chair)chair) | | | 8,000 | |

The annual retainers are earned on a quarterly basis based on a calendar quarter and are paid by the

Companycompany in arrears not later than the fifteenth day following the end of each calendar quarter. In the event a

Non-Employee Directornon-employee director does not serve as a

Directordirector or in the applicable committee or board positions for an entire calendar quarter, such

Directordirector will receive a

proratedpro-rated portion of the applicable retainers otherwise payable to such

Directordirector for such calendar quarter. We also reimburse our

Non-Employee Directornon-employee director for any travel or other business expenses related to their service as a

Director.director.

In addition to the annual cash retainers, each

Non-Employee Directornon-employee director receives an annual restricted stock unit grant with a fair market value on the date of grant of $150,000 per year, which is made pursuant to the BJ’s Wholesale Club Holdings, Inc. 2018 Incentive Award Plan (the “2018 Plan”). The annual equity award will be granted on the date of the

Annual Meetingannual meeting of

Shareholdersshareholders or on the date of such

Director’sdirector’s election or appointment to the

Board of Directors,board, which awards will also be prorated if a

Directordirector is elected or appointed as of a date other than the date of the

Annual Meetingannual meeting of

Shareholders. Each Director may elect to defer the annual restricted stock unit grant, subject to compliance with Section 409A of the Code, and the Board of Directors may determine, in its sole discretion, that such annual equity grant be in the form of deferred stock or in shares of common stock with equivalent value on the date of grant.shareholders. Each equity award will vest and become exercisable on the earlier of (i) the day immediately preceding the date

Annual Meeting of

Shareholdersthe first annual meeting of shareholders following the date of grant and (ii) the first anniversary of the date of grant, subject to the

Directordirector continuing in service on the

Board of Directorsboard through the applicable vesting date. No portion of an annual equity award that is unvested or

unexerciseableunexercisable at the time of a

Director’sdirector’s termination of service on the

Board of Directorsboard will become vested and exercisable thereafter. In the event a

Directordirector is terminated upon or within 12 months following a change in control, as defined in the 2018 Plan, such

Director’sdirector’s outstanding equity awards will accelerate and vest in full.

Director

Stock Ownership Guidelinesstock ownership guidelines

The

Boardboard adopted the

Director Stock Ownership Guidelines,director stock ownership guidelines, pursuant to which

Non-Employee Directorsnon-employee directors are required to own equity in the

Companycompany at least equal to five times their retainer within five years of their election or appointment. Please see the disclosure under

"Executive“Executive Compensation—Director and Executive Stock Ownership

Guidelines"Guidelines” for more information.

TABLE OF CONTENTS

Proposal No. 2

Approval, on an Advisory

(Non-Binding) Basis,advisory

(non-binding) basis, of the

Compensation

compensation of Our

Named Executive Officers

our

named executive officers | | | As required by Section 14A(a)(1) of the Exchange Act, the below resolution enables our shareholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement. This proposal (the "Say-on-Pay Vote"“Say-on-Pay Vote”), and commonly known as a "say-on-pay"“say-on-pay” proposal, gives our shareholders the opportunity to express their views on our NEOs'NEOs’ compensation. The Say-on-Pay Vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this Proxy Statement. We submit the compensation of our NEOs to our shareholders for a non-bindingnon- binding advisory vote on an annual basis. Based on the non-binding advisory vote regarding the frequency of future |

| executive compensation advisory votes conducted at the 2020 Annual Meeting of Shareholders, the next vote on the non-binding advisory frequency of such non-binding advisory votes will occur no later than our 2025 Annual Meeting of Shareholders. |

| | | The Boardboard unanimously recommends that you vote “FOR” this advisory proposal. |

|

We encourage our shareholders to review the

"Executive Compensation"“Executive Compensation” section of this Proxy Statement for more information. As an advisory approval, this proposal is not binding upon us or the

Board of Directors.board. However, the

Compensation Committee,compensation committee, which is responsible for the design and administration of our executive compensation program, values the opinions of our shareholders expressed through your vote on this proposal. The

Boardboard and

Compensation Committeethe compensation committee will consider the outcome of this vote in making future compensation decisions for our named executive officers. Accordingly, we ask our shareholders to vote

"FOR"“FOR” the following resolution at the Annual Meeting:

"

“RESOLVED, that the shareholders of BJ’s Wholesale Club Holdings, Inc. approve, on an advisory basis, the fiscal year

20212023 compensation of BJ’s Wholesale Club Holdings, Inc.’s named executive officers as described in the Compensation Discussion and Analysis and disclosed in the Summary Compensation Table and related compensation tables and narrative disclosure set forth in BJ’s Wholesale Club Holdings, Inc.’s Proxy Statement for the

20222024 Annual Meeting of Shareholders.

"”

Board

Recommendationrecommendation

The

Board of Directorsboard unanimously recommends you vote

FOR the resolution to approve, on an advisory (non-binding) basis, the compensation of our NEOs, as

discloseddescribed in the Compensation Discussion and Analysis

and disclosed in the

accompanyingSummary Compensation Table and related compensation tables and

related narrative disclosure

ofset forth in this Proxy Statement.

TABLE OF CONTENTS

Compensation Discussion and Analysis

This section

(“Compensation Discussion and Analysis”) discusses the philosophy and material components of our executive compensation program for our named executive officers and the objectives driving the associated practices and decisions.

Our executive compensation program is designed to be flexible and complementary and to collectively serve the principles and objectives of our compensation and benefits programs, including to reflect shareholder values, enhance the link between executive pay and company performance, respond to changing market practices and retain effective leaders who have a significant understanding of our business.

Named

Executive Officersexecutive officers

Our NEOs for fiscal year

20212023 were:

| | | | |

|  |  |  |  |

Bob Eddy

President and

Chief Executive Officer

| Laura Felice

Executive Vice President,

Chief Financial Officer

| Paul Cichocki

Executive Vice President,

Chief Commercial Officer

| Jeff Desroches

Executive Vice President,

Chief Operations Officer

| Bill Werner

Executive Vice President,

Strategy and Development

|

This discussion

Executive compensation philosophy and

analysis also covers compensation and benefits for fiscal year 2021 for Mr. Lee Delaney, who served as our President and Chief Executive Officer until his unexpected passing in April 2021. See “—Compensation Discussion and Analysis—Compensation of Mr. Delaney” for more information regarding Mr. Delaney’s fiscal year 2021 compensation. For all other sections included under “Executive Compensation”, Mr. Delaney is also included as an NEO.Executive Compensation Philosophy and Objectives

objectives

Our executive team is critical to our success and to building value for our shareholders. The principles and objectives of our executive compensation program are to:

ATTRACT

, engage and retain the best executives, with experience and managerial talent, enabling us to be an employer of choice in a highly competitive and dynamic industry

ALIGN

compensation with our corporate strategies, business and financial objectives and the long-term interests of our shareholders

MOTIVATE

and reward executives whose knowledge, skills and performance ensure our continued success

ENSURE

that our total compensation is fair, reasonable and competitiveTABLE OF CONTENTS

Elements of

Compensationcompensation

The principal components of our executive compensation program are designed to fulfill one or more of the principles and objectives described above. Compensation of our NEOs includes each of the following key elements:

| | | Base Salarysalary

| Fixed

Short-Term

Cash

| | Fixed

short-term

cash

| | | Provides market-competitive fixed cash compensation reflecting role, responsibility and experience.

Represents 12% of CEO target compensation and 20% - 25% of other NEO target compensation. |

| | | |

| Annual Incentive Plan Awardsawards(1)

| Variable

Mid-Term

Cash

| | Variable

mid-term

cash

| | | Earned based on achievement of a pre-established Companypre-established company financial metric (Adjusted

EBITDA)metrics (adjusted EBITDA and comparable club sales). Designed to align pay to both individual

and Companycompany performance for the fiscal year.

Represents 18% of CEO target compensation and 18% - 21% of other NEO target compensation. |

| Long-Term Incentive Awards*

| Variable

Long-Term

Equity

| Long-term incentive awards(2)

| | | Variable

long-term

equity

| | | Designed to drive Companycompany performance; align interests with shareholders; and encourage long- termlong-term retention of executives.

Represents 70% of CEO target compensation and 55% - 60% of other NEO target compensation |

*Annual performance share unit awards represent 50% of long-term incentive awards, vest over a three-year period and are earned based on the achievement of cumulative adjusted EPS growth compared to goals established by the Compensation Committee. The shares earned pursuant to these awards, if any, will cliff vest as of the end of the performance period, based on continued employment through such date. Annual restricted stock awards represent the remaining 50% of long-term incentive awards and vest ratably over a three-year grant period.

(1)

| 70% of award achievement is based on adjusted EBITDA goal and 30% of award achievement is based on comparable club sales goal. |

(2)

| Annual performance share unit awards represent 50% of long-term incentive awards, vest over a three-year period and are earned based on the achievement of cumulative adjusted EPS growth compared to goals established by the compensation committee. The shares earned pursuant to these awards, if any, will cliff vest as of the end of the performance period, based on continued employment through such date. Annual restricted stock awards represent the remaining 50% of long-term incentive awards and vest ratably over a three-year grant period. |

We view each component of our executive compensation program as related, but distinct, and we also regularly reassess the total compensation of our executive officers to ensure that our overall compensation objectives are met. In addition, we have determined the appropriate level for each compensation component, which is based on our understanding of the competitive market based on the experience of

the members of the

Compensation Committee,compensation committee, advice and information provided by Exequity

(as defined and described below in “Engagement of compensation consultant”), our recruiting and retention goals, our view of internal equity and consistency, the length of service of our executive officers, our and each executive officer’s overall performance, and other considerations the

Compensation Committeecompensation committee considers relevant. Our executive compensation program is designed to be flexible and complementary and to collectively serve all of the executive compensation principles and objectives described above.

We offer cash compensation, in the form of base salaries, annual

Companycompany performance-based

bonusesincentives and, as circumstances warrant, discretionary individual performance-based

bonuses,incentives, that we believe appropriately rewards our executive officers for their contributions to our business. When making awards, the

Compensation Committeecompensation committee considers the

Company’scompany’s financial and operational performance. A key component of our executive compensation program is long-term incentive awards, which are comprised of performance-based and time-based awards as noted above. We emphasize the use of long-term equity awards to incentivize our executive officers to focus on the growth of our overall enterprise value and, correspondingly, the creation of value for our shareholders. Except as described below, we have not adopted any formal or informal policy or guidelines for allocating compensation between currently paid and long-term compensation, between cash and non-cash compensation, or among different forms of non-cash compensation.

Each of the primary elements of our executive compensation program is discussed in more detail below.

TABLE OF CONTENTS

Key

Compensation Practicescompensation practices

The following table highlights key features of our executive compensation program that demonstrate the

Company’scompany’s ongoing commitment to promoting shareholder interests through sound compensation governance practices.

| | | | WHAT WE DO | | | | | | WHAT WE DON'T DO |

| | | Align the interests of our NEOs with those of our long-term investors by awarding a meaningful percentage of total compensation in the form of equity |  | | | | | Do not allow hedging or pledging of Companycompany securities |

| | | |

| Grant annual cash incentive compensation opportunities based on pre-established Companycompany goals |  | | | | | Do not provide for "single trigger"“single trigger” payment of cash severance or acceleration of time-based equity upon a change in control |

| | | |

| Have robust equity ownership guidelines for our Directorsdirectors and executive officers (for our CEO, 5x base salary) |  | | | | | Do not provide for Section 280G excise tax gross-up payments |

| | | |

| Have a clawback policy that allows for the recovery of previously paid incentive compensation in the event of a financial restatement |  | | | | | Do not encourage unnecessary or excessive risk-taking as a result of our compensation policies |

| | | |

| Engage an independent compensation consultant to advise the Compensation Committeecompensation committee |  | | | | | Do not allow for repricing of stock options without shareholder approval |

Roles of the Compensation Committee, Chief Executive Officercompensation committee, chief executive officer and Managementmanagement in Compensation Decisions

compensation decisions

Role of the

Compensation Committeecompensation committee

The

Compensation Committeecompensation committee oversees key aspects of the

Company’scompany’s executive compensation programs, including, base salaries, annual incentive and long-term incentive awards, and perquisites or other benefits for the

Company’scompany’s executive officers, including our NEOs. The

Compensation Committeecompensation committee approves performance goals for awards granted under our incentive compensation programs. In making its decisions the

Compensation Committeecompensation committee considers a variety of factors, including, but not limited to:

| | |

| • | our view of the strategic importance of the position; |

our view of the strategic importance of the position;

our evaluation of the competitive market based on the experience of the members of the Compensation Committeecompensation committee with other companies and market information we may receive from executive search firms retained by us;

our financial condition and available resources;

the length of service of an individual; and

the compensation levels of our other executive officers, each as of the time of the applicable compensation decision.

Role of the

Chief Executive Officerchief executive officer and

Managementmanagement

The

Chief Executive Officerchief executive officer and management team manage the compensation programs based on the

Compensation Committee’scompensation committee’s decisions and directives. The

Chief Executive Officerchief executive officer makes recommendations to the

Compensation Committeecompensation committee regarding compensation of executive officers other than himself.

Engagement of

Compensation Consultantcompensation consultant

The

Compensation Committeecompensation committee is authorized to retain the services of one or more executive compensation advisors, in its discretion, to assist with the establishment and review of our compensation programs and related policies. In accordance with its authority to retain consultants and advisors described above, the

Compensation Committeecompensation committee continued to engage the services of Exequity, LLP

("Exequity"(“Exequity”), a national compensation consulting firm, as its compensation consultant to provide executive compensation advisory services, help evaluate our compensation philosophy and objectives and provide guidance in administering our compensation program and policies.

All services related to executive compensation provided by Exequity during fiscal year

20212023 were conducted under the direction or authority of the

Compensation Committee,compensation committee, and all work performed by Exequity was pre-approved by the

Compensation Committee.compensation committee. Neither Exequity nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. Additionally, during fiscal year

2021,2023, Exequity did not provide any services to us unrelated to executive and

Directordirector compensation.

The Compensation Committeecompensation committee evaluates Exequity's independence on an annual basis and has evaluated whether any work provided by Exequity raised any conflict of interest under applicable SEC or NYSE rules for services performed during fiscal year 20212023 and determined that it did not.

TABLE OF CONTENTS

Key

Fiscal Year 2021 Compensation Decisionsfiscal year 2023 compensation decisions

The

Compensation Committeecompensation committee generally approves annual compensation levels for NEOs in the first quarter of each fiscal year, though it may make adjustments to compensation at other times of the year. When determining base salaries, annual

bonuses,incentives, long-term incentive awards, and other forms of compensation, the

Compensation Committeecompensation committee takes into consideration a variety of information, including, but not limited to, data generated from the compensation practices of its peer group companies, internal equity, an executive’s experience, knowledge of our business and the retail industry, scope of responsibility, corporate performance and individual performance. In particular, the

Compensation Committeecompensation committee made the following key compensation decisions for fiscal year

2021:2023:Increased each NEO'sincreased base salary for all NEOs as further described in "Base Salary"“Base salary” below;

Increased each NEO’sincreased target annual cash incentive award opportunities under our incentive plan;

Awarded promotional awards to Messrs. Eddy, Cichocki, and Werner and Ms. FeliceAnnual Incentive Plan for certain NEOs in accordance with base salary adjustments and/or increased target payout percentage for his or her fiscal year 2023 award, as further described in "—Promotion Awards"“Annual Incentive Plan Awards” below; and

Awarded equity inincreased annual long-term incentive awards (in the form of restricted stock in amounts consistent with fiscal year 2020awards and performance share units tied to a three-year cumulative adjusted EPS goal for fiscal year 2021performance-based stock units) as further described in "—Long-Term Incentive Awards" below.“Long-term incentive awards” below; and

determined that our NEOs earned 200% of their respective target performance share unit awards granted in fiscal year 2020, which represented 50% of their long-term incentive compensation awards for that year, and were earned on March 31, 2023, for the three-year performance period from February 2, 2020 to January 28, 2023.

Assessing

Competitive Practice Through Peer Group Comparisonscompetitive practice through peer group comparisons

To gain a general understanding of our current compensation practices, the

Compensation Committeecompensation committee reviews the compensation of executives serving in similar positions at peer group companies. The external market data reviewed for fiscal year

20212023 was provided by Exequity.

In reviewing and developing the peer group companies for fiscal year 2021,2023, the Compensation Committeecompensation committee considered, at the recommendation of Exequity, industry, annual revenue, market capitalization, enterprise value, EBITDA and gross margin, among other factors for each company. With respect to its executive compensation program, the Companycompany is reasonably positioned near the median of the peer group companies based on annual revenuemarket capitalization and market capitalization.enterprise value. The peer group companies, along with other market data, used for benchmarking our executive compensation program for fiscal year 2021 was the same as the peer group companies for fiscal year 2020. The Compensation Committeecommittee reviews and develops the peer group companies annually with input from Exequity. In its 20212022 review of the peer group for setting 2022fiscal year 2023 compensation, the Compensation Committeecompensation committee removed The Michaels Companies, Inc in connection with it being acquired by ApolloBed Bath & Beyond, Inc. and added Albertsons Companies, Inc. and Petco Health and Wellness Company,Ross Stores, Inc. to the peer group as identified and recommended by Exequity.

Exequity based on the factors set forth above.Fiscal year 2023 executive compensation peer group companies(2)

Fiscal Year 2021 Executive Compensation Peer Group CompaniesCompany name | | | GICS industry |

Company NameAlbertsons Companies, Inc. | GICS Industry | | Food Retail |

Bed Bath & Beyond, Inc.(1) | | | Home Furnishing Retail |

| Big Lots, Inc. | | | General Merchandise Stores |

| Burlington Stores, Inc. | | | Apparel Retail |

| Dick's Sporting Goods, Inc. | | | Specialty Stores |

| Dollar General Corporation | | | General Merchandise Stores |

| Dollar Tree, Inc. | | | General Merchandise Stores |

| Foot Locker, Inc. | | | Apparel Retail |

| Kohl's Corporation | | | Department Stores |

The Michaels Companies,Petco Health and Wellness Company, Inc. | | | Specialty Stores |

| Sprouts Farmers Market, Inc. | | | Food Retail |

| Target Corporation | | | General Merchandise Stores |

| The TJX Companies, Inc. | | | Apparel Retail |

| Williams-Sonoma, Inc. | | | Home Furnishing Retail |

(1)

| On June 15, 2023, BJ’s approved removal of Bed, Bath & Beyond, Inc. as a peer group company for future compensation determinations after it filed for Chapter 11 bankruptcy protection. |

(2)

| On June 15, 2023, BJ’s approved the addition of Ross Stores, Inc. as a peer group company for future compensation determinations. |

In fiscal year 2021,2023, the Compensation Committeecompensation committee considered the pay practices and compensation levels of executives serving in similar positions at the peer group companies when it determined the base salary adjustments, the promotional awards, the change in the target payout levels under our Annual Incentive Plan and the size and mix of equity awards granted to our NEOs, each as described below.

TABLE OF CONTENTS

We believe it is important to provide a competitive fixed level of pay to attract and retain experienced and successful executives. Annual base salaries compensate our NEOs for fulfilling the requirements of their respective positions and provide them with a level of cash income predictability and stability with respect to a portion of their total compensation.

The following table sets forth fiscal year

20212023 and fiscal year

20202022 annual base salaries for our NEOs:

| Named Executive Officer | | Fiscal Year 2021 Base Salary(1) | | Fiscal Year 2020 Base Salary(2) | | Percentage Change |

| Bob Eddy | | $ | 1,200,000 | | | | $ 800,000 | | | 50 | % |

| Laura Felice | | 600,000 | | | 400,000 | | | 50 | |

| Paul Cichocki | | 850,000 | | | 750,000 | | | 13 | |

| Jeff Desroches | | 600,000 | | | 550,000 | | | 9 | |

| Bill Werner | | 530,000 | | | 385,000 | | | 38 | |

| Named executive officer | | | Fiscal year 2023

base salary

($)(1) | | | Fiscal year 2022

base salary

($)(2) | | | Percentage (%)

change |

| Bob Eddy | | | 1,350,000 | | | 1,200,000 | | | 12.5 |

| Laura Felice | | | 750,000 | | | 675,000 | | | 11.1 |

| Paul Cichocki | | | 900,000 | | | 850,000 | | | 5.9 |

| Jeff Desroches | | | 650,000 | | | 625,000 | | | 4.0 |

| Bill Werner | | | 575,000 | | | 539,044 | | | 6.7 |

| (1) | Base salaries for Messrs. Eddy, Cichocki, and Werner and Ms. Felice were effective April 19, 2021 in connection with their respective appointments to their current roles and have been annualized based on such increased amounts. Mr. Desroches base salary was effective April 1, 2021 and has been annualized based on such increased amount. |

(2)

| Base salaries were effective as of April 1, 20202, 2023 for fiscal year 20202023 and have been annualized based on such amounts. |

(2)

| Base salaries were effective April 3, 2022 for fiscal year 2022 and have been annualized based on such amounts. |

The base salaries of our executive officers, including our NEOs, are reviewed periodically by the

Compensation Committeecompensation committee and our

Chief Executive Officerchief executive officer (except with respect to his own base salary), and adjustments are made as deemed appropriate. In determining the amount of base salary that each NEO receives, we consider the executive’s current compensation, tenure, any change in the executive’s position or responsibilities and the complexity and scope of the executive’s position and responsibilities as compared to those of other executives within the

Companycompany and in similar positions at the peer group companies.

The increases to the base salaries of our NEOs for fiscal year 20212023 were designed to maintain or establish, as applicable, each NEO’s base salary near the median of his or her counterparty within the peer group companies and were based on the Compensation Committee’scompensation committee’s review of the benchmarking data for the peer group companies provided by Exequity. The additional increases in Messrs. Eddy’s, Cichocki’s and Werner’s and Ms. Felice’s base salaries were made based on a review of competitive market data for their respective positions and to reflect their promotions and their responsibilities in their respective new roles.

Annual Incentive Plan

Awardsawards

Our Annual Incentive Plan, which became effective on January 29, 2017 (the "Annual“Annual Incentive Plan"Plan”), is designed to reward participants, including our NEOs, for their contributions to the Companycompany based on the achievement of a pre-established company financial metric, Adjusted EBITDA. We use Adjustedmetrics, adjusted EBITDA which we define as income from continuing operations before interest expense, net, provision (benefit) for income taxes and depreciation and amortization, adjusted for the impact of certain other items, including: compensatory payments related to options; stock-based compensation expense; pre-opening expenses; management fees; non-cash rent; strategic consulting; costs related to our IPO and the registered offerings by selling shareholders;comparable club closing and impairment charges; reduction in force severance; gas profit outside of a specific collar and other adjustments as determined by the Compensation Committee, to set our performance target under the Annual Incentive Plan because we believe it is a key financial metric measuring the progress of our operational strategy.sales. As each NEO’s performance contributes to this metric,these metrics, we believe it providesthey provide a fair and objective basis on which to evaluate each NEO’s performance and to determine each NEO’s annual cash incentive award under the Annual Incentive Plan.

Financial

performance metric

(weighting) | | | Definition | | | Rationale for selection |

Adjusted EBITDA

70% | | | Income from continuing operations before interest expense, net, provision for income taxes and depreciation and amortization, adjusted for the impact of certain other items, including stock-based compensation expense; acquisition and integration costs; home office transition costs; restructuring and other adjustments, pre-opening expense, non-cash rent expense and specified litigation expense; and, for purposes of setting our performance target under the Annual Incentive Plan, excluding gas profit outside of a specific collar and other adjustments as determined by the compensation committee. | | | • Creates a strong focus on our overall profit goal and underlying drivers of revenue growth, cost control, cash generation and ultimately total shareholder return.

• Directly measures the progress we are making on our strategic growth initiatives. |

Comparable club sales

30% | | | Comparable club sales, also known as same-store sales, includes all clubs that were open for at least 13 months at the beginning of the period and were in operation during the entirety of both periods being compared, including relocated clubs and expansions. | | | • Key valuation driver in the retail industry.

• Key financial metric in measuring the company’s performance and demonstrates the effectiveness of our core business activities. |

TABLE OF CONTENTS

The

Compensation Committeecompensation committee assigns our NEOs an annual cash incentive target opportunity expressed as a percentage of base salary. For fiscal 2023, these formula-driven cash payouts could have ranged from zero, if company performance fell below minimum thresholds, to 100% of annual incentive opportunity, if the targets were met, and up to a maximum of 200% of the target annual incentive opportunity if performance exceeded target. Our Annual Incentive Plan provides the compensation committee with the authority to reduce the amount of annual cash incentive award paid to a participant, or some or all participants, if the compensation committee determines that such reduction is appropriate. The compensation committee established minimum, target

range and maximum levels of performance for the

Adjustedadjusted EBITDA

goaland comparable club sales goals shortly after the beginning of fiscal year

2021,2023, based on an assessment of the operating landscape for fiscal year

2021,2023, which may result in variations in these established levels from year to year.

Overall, the goals for Adjusted EBITDA for fiscal year 2021 were largely consistent with the prior year, however, slight increases were made to the goals for Adjusted EBITDA for fiscal year 2021 and the Adjusted EBITDA goal for target was changed from a discrete target to a range due to the novel coronavirus (COVID-19) pandemic and goal-setting challenges it has resulted in for compensation. Pursuant to these levels of performance, each NEO could earn 0%, 100% or 200%, respectively, of his or her target annual cash incentive award.Additionally, the Compensation Committee established an aggregate target amount of the bonus pool for fiscal year 2021 for purposes of determining the impact on each NEO’s cash incentive award of Adjusted EBITDA for fiscal year 2021 being greater than or less than the target performance level (the "Target Bonus Pool"). To the extent Adjusted EBITDA for fiscal year 2021 exceeded the target performance level, then the amount of the actual bonus pool would equal the sum of (i) the Target Bonus Pool and (ii) one-third of the amount by which Adjusted EBITDA for fiscal year 2021 (without taking into account the reduction to Adjusted EBITDA resulting from cash incentive awards above the target awards amounts) exceeded the target performance level. If Adjusted EBITDA for fiscal year 2021 was less than the target performance level, then the amount of the actual bonus pool would be calculated by subtracting (i) an amount equal to one-half of the amount by which the target performance level fell short of the Adjusted EBITDA for fiscal year 2021 (without taking into account the impact to Adjusted EBITDA resulting from cash incentive awards below the target awards amounts) from (ii) the Target Bonus Pool. The amount of each NEO’s annual cash incentive award, as a percentage of the target set for each NEO, is equal to the size of such actual bonus pool as a percentage of the Target Bonus Pool (up to a maximum of 200%).

The table below illustrates the relationship between

Adjustedactual adjusted EBITDA

and comparable club sales performance for fiscal year

2021,2023 as compared to performance targets, the percentage of performance targets earned and the resulting aggregate cash incentive

awards as a percentage of target performance and the size of the bonus pool,award attainment determined with interpolation applying for amounts between

levels, as well as actual performance for fiscal year 2021, the percentage of target earned and the actual bonus pool.| | Adjusted

EBITDA | Payout | Bonus Pool |

| (dollars in millions) | | | |

| Minimum | $ | 666 | 0 | % | $ | 0 |

| Target (Low) | 702 | 100 | | 35 |

| Target (High) | 722 | 100 | | 35 |

| Maximum | 794 | 200 | | 71 |

| Actual | 880 | 200 | | 71 |

The Compensation Committee determined that Adjusted EBITDA for fiscal year 2021 was greater than the maximum performance level, which resulted in an achievement level of 200%. Additionally, the total bonus pool was correspondingly increased by 1/3 the amount by which Adjusted EBITDA for fiscal year 2021 exceeded the target performance level.

levels.

| (dollars in millions) | | | Adjusted

EBITDA

($)(1) | | | Comparable

club sales

($) | | | Payout

(%) |

| Minimum | | | | | | 1,058 | | | | | | 15,036 | | | | | | 0 | | | |

| Target | | | | | | 1,102 | | | | | | 15,996 | | | | | | 100 | | | |

| Maximum | | | | | | 1,191 | | | | | | 16,636 | | | | | | 200 | | | |

| Actual | | | | | | 1,088(2) | | | | | | 15,457 | | | | | | 60 | | | |

| Achievement (%) | | | | | | 67 | | | | | | 44 | | | | | | | | | |

(1)

| The compensation committee determined that adjusted EBITDA for fiscal year 2023 was $1.088B and the comparable club sales was $15.457B which resulted in an achievement level of 60% for total AIP payout. The weighting of the adjusted EBITDA and comparable club sales goals is 70% and 30%, respectively. The total cash incentive award amounts were paid at lower than target payout amounts due to adjusted EBITDA and comparable club sales for fiscal year 2023 being achieved between the minimum and target performance levels. |

(2)

| Additionally, adjusted EBITDA did not include gas profit outside of a specific collar, and such amounts were therefore excluded from the calculation of the achievement level. |

Each NEO's target annual cash incentive award opportunity is expressed as a percentage of his or her base salary in effect at fiscal year-end and is based on peer group benchmark data and the scope of responsibility and impact the executive has on the

Company'scompany's overall results.

In fiscal year 2021,The compensation committee maintained the

Compensation Committee maintained each NEO's target payout percentage

of Messrs. Eddy and Mr. Cichocki for

his or hertheir respective fiscal year

2021 award,2023 awards, consistent with

their target payout percentages for fiscal year

2020, with2022. The compensation committee increased the

exception of Mr. Eddy's target payout percentage

which was increased to 150% of his base salary from 110% of his base salary and each of Ms.

Felice’sFelice and

Mr. Werner’sMessrs. Desroches and Werner for their respective fiscal year 2023 awards as detailed below. The target payout percentage

which was increased to 70% of their respective base salary from 60% of their respective base salary.Given the base salary increases as well as the increase to the size of the total bonus pool, however, each NEO's target annual cash incentive award opportunity increased. These increases, as well as the increase in Messrs. Eddy's and Werner’s and Ms. Felice’s target payout percentages, were intended to more closely align each NEO'sNEOs potential annual total cash compensation more closely with the median of the annual total cash compensation paid to executives with similar roles and responsibilities at the peer group companies.

companies and were based on the compensation committee’s review of the benchmarking data for the peer group companies provided by Exequity.

Further, given the base salary increases for each of our NEOs in fiscal year 2023, each NEO's target annual cash incentive award opportunity increased for fiscal year 2023.

The following table sets forth fiscal year

20212023 target

bonusesincentives for each of our NEOs as a percentage of base salary, the percentage of target

bonusincentive earned for each NEO as a percentage of base salary and the cash incentive award amounts that were paid to each NEO for fiscal year

20212023 based on the achievement of the

Adjusted EBITDA goalgoals described above.

| Named Executive Officer | Annual Incentive Plan Target Bonus (1) | Annual Incentive

Plan Target Bonus | Earned | Cash Incentive

Award Amount (2) |

| Bob Eddy (3) | 150 | % | | $ | 1,800,000 | | 300 | % | | | $ 3,600,000 | |

| Laura Felice (4) | 70 | | | 420,000 | | 140 | | | 840,000 | |

| Paul Cichocki (5) | 100 | | | 850,000 | | 200 | | | 1,700,000 | |

| Jeff Desroches | 70 | | | 420,000 | | 140 | | | 840,000 | |

| Bill Werner(6) | 70 | | | 371,000 | | 140 | | | 742,000 | |

| Named executive officer | | | Annual Incentive Plan

target incentive

percentage

(%)(1) | | | Annual Incentive

Plan target

incentive

($)(2) | | | Percentage earned

(%) | | | Cash incentive

award

amount

($)(3) |

| Bob Eddy | | | 150 | | | 2,025,000 | | | 60 | | | 1,215,000 |

| Laura Felice | | | 85 | | | 637,500 | | | 60 | | | 382,500 |

| Paul Cichocki | | | 100 | | | 900,000 | | | 60 | | | 540,000 |

| Jeff Desroches | | | 75 | | | 487,500 | | | 60 | | | 292,500 |

| Bill Werner | | | 75 | | | 431,250 | | | 60 | | | 258,750 |

(1)

| Fiscal year 20212023 was 5253 weeks long. Each executive’s target bonusincentive was a percentage of their base salary as of January 29, 2022.February 3, 2024. |

(2)

| Calculated as Annual Incentive Plan target incentive percentage multiplied by the NEO’s annual salary. |

(3)

| Cash incentive award amounts earned for fiscal year 20212023 were paid in March 2022. |

(3) | Mr. Eddy was appointed as the Company’s President and Chief Executive Officer effective April 19, 2021. |

(4) | Ms. Felice was appointed as the Company’s Executive Vice President, Chief Financial Officer effective April 19, 2021. |

(5) | Mr. Cichocki was appointed as the Company’s Executive Vice President, Chief Commercial Officer effective April 19, 2021. |

(6) | Mr. Werner was appointed as the Company’s Executive Vice President, Strategy and Development effective April 19, 2021.2024. |

TABLE OF CONTENTS

Long-Term Incentive Awards

Long-term incentive awards

For fiscal year

2021,2023, each of our NEOs received long-term incentive awards comprised of performance share units and restricted stock awards. We designed these awards primarily to motivate, reward and retain our executive officers in a manner that best aligns their interests with the interests of our shareholders. Our executive officers earn performance share units based on the achievement of pre-defined cumulative adjusted EPS goals over a three-year performance period, determined by the

Compensation Committee,compensation committee, and we believe these types of awards provide a direct line of sight for the NEOs between our financial performance and their long-term incentive rewards. Furthermore, the restricted stock component of our long-term incentive awards closely

alignaligns the incentives provided by these awards with the interests of our shareholders as our executive officers benefit from restricted stock awards when the market price of our common stock increases and all changes to the value of stock, whether positive or negative, directly correspond to those experienced by our shareholders. Therefore, we believe that restricted stock awards and performance share units provide meaningful incentives to our executive officers to achieve increases in the value of our stock over time and are an effective tool for meeting our compensation goals of increasing long-term shareholder value by tying the value of the awards to our future performance and by aligning executive officer compensation with the interests of our shareholders.

Historically, when determining the amount and terms of equity compensation awards, we considered, among other things, market information provided by Exequity, individual performance history, job scope, function, title, outstanding and unvested equity awards and comparable awards granted to other executives at similar levels at the peer group companies. The

Compensation Committeecompensation committee has also drawn upon the experience of its members in making such determinations.

Based on these considerations, the Compensation Committeecompensation committee determined not to increase the long-term incentive award amounts for the NEOs for fiscal year 2021. 2023 in order to remain competitively positioned with their respective counterparties within the peer group companies and was based on the compensation committee’s review of the benchmarking data for the peer group companies provided by Exequity.

Target Long-Term Incentive Values

| Name | | | 2023

($) | | | 2022

($) | | | Change

(%) |

| Bob Eddy | | | 8,000,000 | | | 7,000,000 | | | 14.3 |

| Laura Felice | | | 1,700,000 | | | 1,500,000 | | | 13.3 |

| Paul Cichocki | | | 2,700,000 | | | 2,500,000 | | | 8.0 |

| Jeff Desroches | | | 1,500,000 | | | 1,400,000 | | | 7.1 |

| Bill Werner | | | 1,300,000 | | | 1,100,000 | | | 18.2 |

The following table sets forth the types of awards we granted, weighting (based on target value) allocated to each type of award for each of our NEOs and vesting terms of our long-term incentive compensation for fiscal year

2021:2023:Award Typetype for NEOs | Weighting | | Weighting | | | Vesting Termsterms |

| Performance share units | | | 50% | | | Earned based on the achievement of cumulative adjusted EPS growth compared to goals established by the Compensation Committeecompensation committee and vest over the three-year performance period ending on February 3, 2024.January 31, 2026. The shares earned, if any, will cliff vest as of the end of the performance period, based on continued employment through such date. |

| Restricted stock | | | 50% | | | Vest in three equal annual installments commencing on April 1, 2022,2024, subject to continued employment through such dates. |

In connection with the transition from non-qualified stock options to performance

Performance share

units in fiscal year 2020, the Compensation Committee determined, after consideration of retention factors associated with the equity scheduled to vest each year given the new delayed vesting period associated with the performance shares units as opposed to the annual vesting associated with the non-qualified stock options, to grant cash transitionunit awards

equivalent to 25% of the annual long-term incentive award grant, with one-third of the cash transition award vesting after one year and the remaining two-thirds of the award vesting the year thereafter. The first cash transition awards were paid in fiscal year 2021.Performance Share Unit Awards

We granted performance share unit awards to our NEOs in fiscal year 20212023 for 50% of their long-term incentive compensation awards. The performance share unit awards may be earned by our NEOs based on cumulative adjusted EPS growth achieved over a three-year performance period from January 30, 202129, 2023 to February 3, 2024.January 31, 2026. Cumulative adjusted EPS means the sum of the earnings per share, determined by the Compensation Committeecompensation committee in its sole discretion in accordance with generally accepted accounting practices in the United States, for each of the three fiscal years in the applicable performance period, adjusted to account for: (i) unusual or one-time items of expense or income, including without limitation, asset impairment charges, charges associated with closing or relocating of a club, charges related to debt refinancing or other capital market transactions; (ii) income or expense related to discontinued operations; (iii) restructuring charges including severance charges related to the restructuring and any other non-recurring or out of period charge as approved by the compensation committee and the tax impact of the foregoing adjustments on net income; (iv) the effects of acquisitions, divestitures, stock split-ups, stock dividends or distributions, recapitalizations, warrants or rights issuances or combinations, exchanges or reclassifications with respect to any outstanding class or series of our common stock; (v) a corporate transaction, such as any merger of the Companycompany with another corporation, any consolidation of the Companycompany and another corporation into another corporation, any separation of the Companycompany or its business units; or (vi) any reorganization of

TABLE OF CONTENTS

us, or any partial or complete liquidation or sale of all or substantially all of our assets. We use cumulative adjusted EPS to set our performance target under the performance share unit awards because we believe (a) it aligns closely with overall shareholder value and indicates our ability to create the same and (b) it is a metric commonly used by companies in our peer group and in the general industry. As each NEO’s performance contributes to this metric, we believe it provides a fair and objective basis on which to evaluate each NEO’s performance and to determine each NEO’s performance share unit award.

The number of units that will be earned, as a percentage of the

of the target number of units granted,

will beis based on threshold, target

range and maximum levels of performance established by the compensation committee shortly after the beginning of fiscal year

2021,2023, based on their assessment of the

Companycompany outlook, which may result in variations in these established levels from year to year.

AsFor fiscal year 2023, consistent with

our Annual Incentive Plan,prior years, the adjusted EPS

target performance

level was changed from a discrete target to a target range due tolevels were increased based on growth expectations for the

novel coronavirus (COVID-19) pandemic and the goal-setting challenges it has resulted in for compensation.business. If our cumulative adjusted EPS does not equal or exceed the threshold level established, then our NEOs will not be entitled to earn any shares pursuant to these performance share units. To the extent our performance falls between two of the established levels of performance, the percentage earned will be determined based on straight-line interpolation between the percentages that would have been earned for the established levels of performance. Pursuant to these levels of performance, each NEO could earn

50%, 100% orbetween 0% and 200%, respectively, of his or her target performance share units. The shares earned, if any, will cliff vest as of the end of the three-year performance period based on continued employment through such date.

The table below illustrates the relationship between level of achievement and the performance share unit awards earned as a percentage of target performance, with interpolation applying for amounts between levels.

| | Fiscal Year 2021 Target Amounts |

| Name | Grant Date Fair

Value | | (Units) (1) |

| Bob Eddy | $ | 1,399,997 | | | 31,496 | |

| Laura Felice (2) | 187,490 | | | 4,218 | |

| Paul Cichocki | 1,124,985 | | | 25,309 | |

| Jeff Desroches | 699,998 | | | 15,748 | |

| Bill Werner (2) | 187,490 | | | 4,218 | |

| | | Fiscal year 2023 target amounts |

| Name | | | Grant date

fair value

($) | | | Units

(#)(1) |

| Bob Eddy | | | 3,999,989 | | | 52,583 |

| Laura Felice | | | 849,930 | | | 11,173 |

| Paul Cichocki | | | 1,349,938 | | | 17,746 |

| Jeff Desroches | | | 749,974 | | | 9,859 |

| Bill Werner | | | 649,942 | | | 8,544 |

(1)

| The target number of units granted to each of our NEOs was determined based on the target dollar value divided by the estimated grant date fair value per unit which was determined by using the fair market value of our common stock on March 31, 2023, the preceding trading day before the grant date (Saturday, April 1, 2023), which was $44.45. |

(2) | Ms. Felice’s and Mr. Werner’s long-term incentive award amounts for fiscal year 2021 consisted of a 25% weighting of performance share unit awards for fiscal year 2021.$76.07. |

Status of Performance Share Unit Awards

We granted annual performance-based restricted share unit awards (“PSU Awards”) to our NEOs in fiscal year 2020, with performance criteria relating to cumulative adjusted EPS growth during the performance period compared to goals established by the compensation committee for the performance period. During fiscal year 2021, we also granted one-time performance-based restricted share unit awards to Messrs. Eddy, Cichocki and Werner and Ms. Felice in connection with their promotions (each, a “PSU Promotion Award”), with the same performance criteria as the PSU Awards for the applicable performance period. See “—Outstanding equity awards at fiscal 2023 year-end” for additional discussion of the outstanding PSU Awards and PSU Promotion Awards.

The table below provides a summary of the 2020 PSU awards paid out in fiscal year 2023 which were paid out at 200% of Target Earned:

| Name | | | PSU target shares | | | PSU vested shares |

| Bob Eddy | | | 55,843 | | | 111,686 |

| Laura Felice | | | — | | | — |

| Paul Cichocki | | | 44,874 | | | 89,748 |

| Jeff Descroches | | | 27,921 | | | 55,842 |

| Bill Werner | | | — | | | — |

TABLE OF CONTENTS

Restricted

Stock Awardsstock awards

We also granted restricted stock awards to our NEOs for fiscal year

2021.2023. These awards comprise 50% of their long-term incentive compensation awards and vest in three equal annual installments commencing on April 1,

2022,2024, subject to continued employment through such dates. The following table sets forth the restricted stock awards granted to each of our NEOs for fiscal year

2021.| | | Fiscal Year 2021 Restricted Stock Awards |

| Name | | Grant Date Fair Value | | Share (#) |

| Bob Eddy | | $ | 1,399,997 | | | 31,496 | |

| Laura Felice (1) | | 562,470 | | | 12,654 | |

| Paul Cichocki | | 1,124,985 | | | 25,309 | |

| Jeff Desroches | | 699,999 | | | 15,748 | |

| Bill Werner (1) | | 562,470 | | | 12,654 | |

2023.(1) | Ms. Felice’s and Mr. Werner’s long-term incentive award amounts for fiscal | | Fiscal year 2021 consisted of a 75% weighting of2023 restricted stock awards.awards |

Promotion Awards

In connection with the promotions of Mr. Eddy, Ms. Felice, Mr. Cichocki and Mr. Werner, each of which were effective April 19, 2021, the Compensation Committee approved awards of performance-based restricted stock units (each a “PSU Promotion Award”) and awards of restricted stock (“Restricted Stock Promotion Awards”) pursuant to the 2018 Plan.

PSU Promotion Awards

The PSU Promotion Awards are subject to the same performance-based vesting hurdles as the performance share units granted to NEOs for fiscal year 2021, which are based on achievement of cumulative adjusted EPS growth during fiscal years 2021, 2022 and 2023, subject to continued employment through such dates. The number of restricted stock units that may be earned pursuant to the PSU Promotion Award range from 50%-200% of the target amount based on the same performance levels as the performance share units granted to NEOs for fiscal year 2021. None of the performance share units will be earned if the minimum performance-based vesting hurdle is not achieved. See “—Performance Share Unit Awards” above for additional information.

The table below illustrates the relationship between level of achievement and the PSU Promotion Award earned as a percentage of target performance, with interpolation applying for amounts between levels.

| | | PSU Promotion Award Target Amounts |

| Name | | Value | | Units(1) |

| Bob Eddy(2) | | $ | 6,599,967 | | | 149,863 | |

| Laura Felice | | 224,957 | | | 5,108 | |

| Paul Cichocki | | 124,986 | | | 2,838 | |

| Bill Werner | | 174,971 | | | 3,973 | |

(1)Name | The target number of units granted to each of our NEOs set forth in the above table was determined based on the target dollar value divided by the estimated grant | | Grant date fair value per unit, which was determined using the fair market value of the Company’s common stock on the grant date, which was $44.04. |

(2)

($) | Represents a promotion award of $1,600,000 and a separate Chief Executive Officer award of $5,000,000. | | Share

(#)(1) |

Restricted Stock Promotion Awards

The Restricted Stock Promotion Awards vest in three equal annual installments commencing on April 1, 2022, subject to continued employment through such dates. The following table sets forth the Restricted Stock Promotion Awards granted to each of the NEOs set forth therein.

| | | Fiscal Year 2020 Restricted Stock Awards |

| Name | | Value | | Shares(1) |

| Bob Eddy | | $ | 1,599,973 | | | 36,330 | |

| Laura Felice | | 224,956 | | | 5,108 | |

| Paul Cichocki | | 124,985 | | | 2,838 | |

| Bill Werner | | 174,971 | | | 3,973 | |

| Bob Eddy | | | 3,999,989 | | | 52,583 |

| Laura Felice | | | 849,930 | | | 11,173 |

| Paul Cichocki | | | 1,349,938 | | | 17,746 |

| Jeff Desroches | | | 749,974 | | | 9,859 |

| Bill Werner | | | 649,942 | | | 8,544 |

(1)

| The target number of shares granted to each of our NEOs set forth in the above table was determined based on the target dollar value divided by the estimated grant date fair value per share which was determined by using the fair market value of the Company’sour common stock on March 31, 2023, the preceding trading day before the grant date (Saturday, April 1, 2023), which was $44.04.$76.07. |

Cash transition awards

In connection with Mr. Werner’s leadership with the strategic evaluation of the Company’s co-branded credit card program (“Co-Brand Initiative”), he received a grant oftransition from non-qualified stock options to performance share units in fiscal year 2020, the compensation committee determined, after considering retention factors associated with a target fair market valuethe equity scheduled to vest each year given the new delayed vesting period associated with the performance shares units as opposed to the annual vesting associated with the non-qualified stock options, to grant cash transition awards equivalent to 25% of $1,199,954 (the “Performance Award”) as well as a restricted stockthe annual long-term incentive award of 5,174 shares, with a fair market value of $299,988 on the grant date (the “RSA”)for fiscal year 2020 (and for Ms. Felice and Mr. Werner, for fiscal year 2021), with one-third of the RSA scheduled to vest on each September 25, 2022, 2023cash transition award vesting after one year and 2024, subject to continued employment with us through such dates. 50%the remaining two-thirds of the Performance Award may vest on each of September 2025 or September 2026, subject to Mr. Werner’s continued service throughaward vesting the end ofyear thereafter. The following table sets forth the applicable performance periodcash transition awards paid in fiscal years 2023, 2022 and 2021.

| Named executive officer | | | Fiscal Year 2023

transition award ($)(1) | | | Fiscal year 2022

transition award ($)(2) | | | Fiscal year 2021

transition award ($)(3) |

| Bob Eddy | | | — | | | 933,333 | | | 466,667 |

| Laura Felice | | | 125,000 | | | 62,500 | | | — |

| Paul Cichocki | | | — | | | — | | | — |

| Jeff Desroches | | | — | | | 466,667 | | | 233,333 |

| Bill Werner | | | 125,000 | | | 62,500 | | | — |

(1)

| The cash transition awards for fiscal year 2023 were paid on April 7, 2023. |

(2)

| The cash transition awards for fiscal year 2022 were paid on April 1, 2022. |

(3)

| The cash transition awards for fiscal year 2021 were paid on April 1, 2021. |

All cash transition awards have been paid and no further cash transition awards are outstanding. At this time, the

co-brand spend during such performance period (“the “Performance Target”). The Compensation Committee shall determine the achievement of the performance goals within the 90-day period following the end of the performance period (such date, the “Determination Date”). If the Performance Target isCompany does not

achieved, 50% of the applicable tranche of the Performance Award may vest if the co-brand spend during the applicable performance period is at least 90% of the Performance Target (the “Floor”) and up to 200% of the shares subject to the Performance Award may vest upon the achievement of 110% of the Performance Target during the applicable performance year (the “Maximum”). Achievement of co-brand spend between the Floor, Performance Target and Maximum levels are determined by linear interpolation, provided that if co-brand spend is less than the Floor, no shares under the applicable Performance Award tranche shall vest. The number of shares subject to the RSA were determined by dividing $299,988 by the per share closing price of the common stock on the grant date.anticipate granting new cash transition awards.

Other

Compensation Componentscompensation components

We have established a 401(k) retirement savings plan for our employees, including our NEOs, who satisfy certain eligibility requirements. Under the 401(k) plan, eligible employees may elect to reduce their current compensation by up to the prescribed annual limit and contribute these amounts to the 401(k) plan. This plan provides for

Companycompany matching contributions of 50% of the first 6% of an employee’s covered compensation.

Executive Retirement Plan

We maintain and Non-Qualified Deferred Compensation Plan

Executive Retirement Plan

Until April 2023, we maintained an executive retirement plan (the “Executive Retirement Plan”) in which a select group of our management and highly compensated employees arewere eligible to participate. Participants arewere selected by the Compensation Committeecompensation committee and arewere entitled to company contributions within 60 days of fiscal year end under the plan (the “Annual Retirement Contribution”) if they arewere actively employed by the Companycompany on the last day of a plan year or if they arewere terminated prior to the end

TABLE OF CONTENTS

of the plan year due to (i) retirement on or after the attainment of age 55 or (ii) disability. Each year the

Company makescompany made an Annual Retirement Contribution to each participant under this plan with at least four years of credited service in an amount equal to at least 3% of the participant’s after-tax base salary earned for such year.

ForDuring fiscal year

2021,2023, we made a contribution of 5% of each NEO’s base salary, consistent with prior years. Annual Retirement Contributions to participants with at least four years of service

arewere considered taxable income to the participants, and we

makemade an additional tax gross-up contribution to each of these participants each year. For participants with less than four years of service by the end of the applicable plan year, the participant

will accrueaccrued the right to an Annual Retirement Contribution each year, and, subject to continued employment, in the plan year in which the participant

iswas first credited with four years of service, the

Company will makecompany made an aggregate retirement contribution on behalf of the participant equal to the amount of the Annual Retirement Contribution for the applicable plan year and the previous three plan years (along with a tax gross-up contribution). Notwithstanding the foregoing, we

have elected to make Annual Retirement Contributions on behalf of Mr. Cichocki though he

hashad not yet achieved four years of credited service. If the employment of Mr. Cichocki is terminated prior to achieving four years of credited service, he will forfeit any

Companycompany contributions made under the plan. Tax gross up payments will be made to Mr. Cichocki when he achieves four years of credited service. Upon a change of control, each participant with less than four years of credited service will become fully vested in any benefit accrued under the plan, and each participant will receive an Annual Retirement Contribution for the year in which the change of control occurs.

Participants generally

maycould elect to invest their balance under the Executive Retirement Plan in a variety of different tax-deferred investment vehicles. However, the

Company selectscompany selected the investments with respect to Annual Retirement Contributions made on behalf of Mr. Cichocki since he

hashad not yet achieved four years of credited service.

Non-Qualified Deferred Compensation Plan

In November 2023, the compensation committee adopted the BJ’s Wholesale Club, Inc. Non-Qualified Deferred Compensation Plan (the “Executive NQDC Plan”) effective on January 1, 2024.

Pursuant to the Executive NQDC Plan, a select group of management or highly compensated employees of the Company (“participants”), including the company’s NEOs, are eligible to participate by making an annual irrevocable election to defer up to fifty percent (50%) of the participant's annual base salary, as well as up to one hundred percent (100%) of any annual cash incentive award. A participant will be 100% vested at all times in their elective deferral account within the Executive NQDC Plan. Deferred amounts are held for each participant in separate individual accounts in an irrevocable rabbi trust. The accounts are credited with earnings or losses based on the rate of return of notional investment options designated by the trustee of the rabbi trust and selected by the participant, which he or she may change at any time.

In addition, the company may elect, during any single plan year, to provide a discretionary contribution to the Executive NQDC Plan to a select management participant on such participant's behalf. Select eligible management participants include the company’s NEOs.

No discretionary contribution under the Executive NQDC Plan was made by the company to our executives for fiscal year 2023.

The benefits under the Executive NQDC Plan will be paid to the participant, or in the event of death, to the participant’s beneficiary, following the earliest of the participant’s separation from service, death, disability, or the specified time elected by the participant, either in installments or in a lump sum payment in accordance with the terms of the Executive NQDC Plan and provisions established by the company. If a participant dies before receiving the full value of the deferral account balances, the designated beneficiary would receive a lump sum of the remaining balance.

Employee

Benefitsbenefits and

Perquisitesperquisites

We design our employee benefits programs to be affordable and competitive in relation to the market, as well as compliant with applicable laws and practices. We adjust our employee benefits programs as needed based upon regular monitoring of applicable laws and practices in the competitive market.

Additional benefits received by our employees, including our NEOs, include medical and dental benefits, flexible spending accounts, short-term and long-term disability insurance and accidental death and dismemberment insurance. We also provide basic life insurance coverage to our employees, as well as executive life insurance to certain key executives, including our NEOs. We reimburse certain financial counseling and estate planning expenses for certain executives, including our NEOs. We believe providing such perquisites enables us to provide a competitive package that allows us to attract and retain top talent.

In addition, Mr. Eddy is provided an allowance to use Companycompany aircraft for personal use. We have a written policy that sets forth guidelines and procedures regarding personal use of Companycompany aircraft. Mr. Eddy (and immediate family members traveling with him) may use our Companycompany aircraft for up to $200,000 per calendar year of personal flight time. We do not reimburse for taxes relating to any imputed income for his personal travel and the personal travel of his family members when they are accompanying him. For fiscal year 2021,2023, the aggregate incremental cost of Mr. Eddy’s personal use of Companycompany aircraft was $48,151.$148,973. Such aggregate incremental cost of the personal use of our Companycompany aircraft reflects the marginal incremental private plane charter costs to the Companycompany and excludes any fixed contract costs.

We design our employee benefits programs to be affordable and competitive in relation to the market, as well as compliant with applicable laws and practices. We adjust our employee benefits programs as needed based upon regular monitoring of applicable laws and practices in the competitive market.

We do not view perquisites, other than the use of Companycompany aircraft as discussed above, or other personal benefits as a significant component of our executive compensation program. We view the personal use of a Companycompany aircraft to be a significant benefit that

TABLE OF CONTENTS

assists us in attracting and retaining top talent while allowing our executives to serve the

Companycompany without personal travel related distractions. In the future, we may provide perquisites or other personal benefits in limited circumstances, such as where we believe it is appropriate to assist an individual executive officer in the performance of his or her duties, to make our executive officers more efficient and effective, and for recruitment, motivation or retention purposes. All future practices with respect to perquisites or other personal benefits for our NEOs will be approved and subject to periodic review by the

Compensation Committeecompensation committee and we do not expect such perquisites to become a significant component of our compensation program.

Severance and

Changechange in

Control Benefitscontrol benefits

We have entered into employment agreements with each of our NEOs and believe that it is in the best interests of our shareholders to extend the severance benefits set forth therein to our executives to reinforce and encourage retention and focus on shareholder value creation without distraction. In determining the appropriate severance entitlements to provide our NEOs,

we looked tothe compensation committee reviewed general market trends in consultation with our compensation

consultant.consultant, Exequity. The material elements of these employment agreements are summarized below under “—

Fiscal Year 2021 Compensation for Chief Executive Officer” and “—Employment Agreements and Potential Payments Upon Termination or Change in Control.”

Executive

Stock Ownership Guidelinesstock ownership guidelines

In order to complement our compensation programs and further align the interests of our NEOs with those of our shareholders, our

Board of Directorsboard adopted

Executive Stock Ownership Guidelinesexecutive stock ownership guidelines pursuant to which (i) our

Chief Executive Officerchief executive officer is required to own equity in the

Companycompany equal to at least five times his annual base salary, (ii) each

Executive Vice Presidentexecutive vice president is required to own equity in the

Companycompany equal to at least three times his or her annual base salary and (iii) each

Senior Vice Presidentsenior vice president is required to own equity in the

Companycompany equal to at least one times his or her annual base salary. Please see the disclosure under “—Director and Executive Stock Ownership Guidelines” for more information.

Additional

InformationAnti-Hedginginformation

Anti-hedging and

Anti-Pledging Policyanti-pledging policy

None of our NEOs has engaged in any hedging transactions with respect to our common stock or pledged any of his or her shares of common stock in the

Company.company. Additionally, our

Board of Directorsboard adopted an

insider trading complianceanti-hedging and anti-pledging policy, which applies to all of our

Directors,directors, officers and certain designated employees. The policy prohibits our

Directors,directors, officers and certain designated employees from engaging in hedging or monetization transactions, such as zero-cost collars and forward sale contracts, short sales and transactions in publicly traded options, such as puts, calls and other derivatives involving our equity securities and also prohibits the pledging of the

Company’scompany’s securities as collateral to secure loans.

Clawback

PolicyWe havepolicy

In fiscal year 2023, the company amended and restated its previously adopted

a clawback policy

in accordance with the SEC’s rules and NYSE’s listing rules. The amended and restated clawback policy provides that

allowsin the

Companyevent the company is required to

recoupprepare a material financial restatement, the company shall reasonably promptly recover the amount of cash and equity incentive compensation

paid to, earnedreceived by

or granted to our executive officers during the three completed fiscal years preceding the publication of a

material financial restatement of the

Company’scompany’s financial statements

if the financial results that

are the subject of a restatement had been materially misstated due to an act of embezzlement, fraud, intentional misconduct or breach of fiduciary duty by any of our executive officers. In such circumstances, the Company may recoupexceeds the amount

of cash and equity incentive compensation that

was paid, earned or granted as a result of the incorrectly reported financial results of the Company that were the subject of the restatement thatotherwise would

not have been

paid, earned or granted, as applicable, ifreceived by the executive officer had such compensation been determined based on the

financial results of the Company set forth or reflectedrestated amounts in the

Company’smaterial financial restatement, computed without regard to any taxes paid. Our amended and restated

financial statements. Our clawback policy applies to all incentive compensation approved or awarded on or after

March 3, 2020.Modification of Equity Award Agreements

In April 2021, following the unexpected passing of Mr. Delaney, the Company reviewed its policy for the treatment of outstanding equity upon termination by reason of death or disability. In connection with this review, the Compensation Committee considered, in consultation with Exequity, data regarding prevalent market practices, including through a review of its peer group’s practices, and determined that the Company’s then current treatment of equity upon death or disability was less favorable than typical market practices. Accordingly, the Compensation Committee determined to modify Mr. Delaney’s awards, and to amend all other outstanding equity award agreements, to provide for, upon termination due to death or disability, as applicable: (i) full vesting of all time-based awards, including restricted stock awards and stock options, (ii) pro-rata vesting of all performance-based awards, including performance share units, based on actual performance as of the end of the applicable performance period, pro-rated based on the period of employment during the applicable performance period, and (iii) the extension of the post-termination exercise window for vested stock options from 90 days to three years. For Mr. Delaney’s estate, these modifications were subject to execution of a release of claims in favor of the Company. In adjusting the treatment of outstanding equity upon termination by reason of death or disability, and modifying Mr. Delaney’s awards, the Compensation Committee intended to position the Company competitively with the market in order to better attract and retain equity-eligible employees and executives as well as to provide a post-termination exercise window that is sufficient to allow for the settlement of outstanding options prior to any court proceedings that may be required with respect to the award recipient’s estate.

Compensation of Mr. Delaney

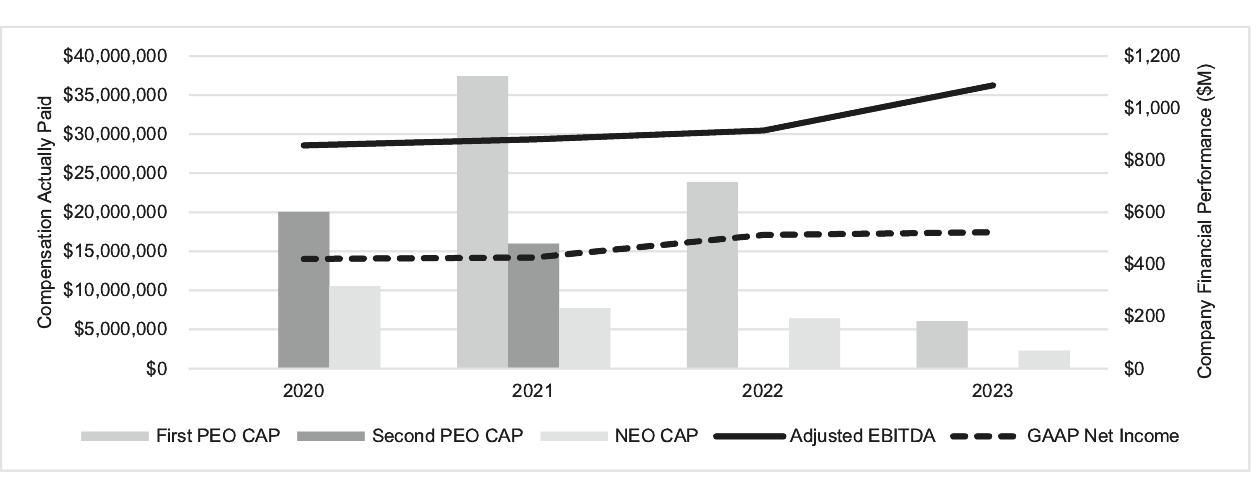

Mr. Delaney’s annual base salary during fiscal year 2021 was $1,230,000 and his target annual cash incentive award was $1,845,000, which was structured in the same manner as the target annual cash incentive awards for our NEOs. In addition, prior to his passing, Mr. Delaney received long-term incentive awards with a target value of $7,125,000, which were comprised of performance share units (with respect to 50% of the target value) and restricted stock (with respect to 50% of the target value) structured in the same manner as the awards received by our NEOs. Mr. Delaney’s base salary, target annual cash incentive award and target long-term incentive awards for fiscal year 2021 were determined based on the same considerations as those for the same type of compensation received by our NEOs for fiscal year 2021. Mr. Delaney’s salary earned through April 8, 2021 was paid to his estate. Mr. Delaney was not eligible to receive his full annual cash incentive award as his employment with the Company ceased during 2021. Mr. Delaney received a pro-rated annual cash incentive award through April 8, 2021.